R&D Units - Funding 2020-2023

Purchase of goods and services

-

Acquisition of goods and services (AQ) and other current expenses directly related to the objectives of the funding (e.g. laboratory consumables, acquisition of instruments, goods for common use directly related to the pursuit of the objectives of the funding, among others).

-

As with the submission of expenses with intra-community VAT, expenses relating to services with IRS withheld should also be submitted on two lines, since the payment of IRS occurs at a different time to the payment for the service. Therefore, in the columns referring to the payment, the elements referring to the payment of the IRS to the State should be submitted (see Expense Submission Manual, page 25, example 4).

Therefore, when there is IRS withheld, the expense on the green receipt must be shown on two lines. One line for the amount received by the service provider and another line with the delivery/payment to the AT of this IRS withheld by the institution.

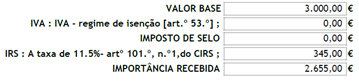

1st Example: w/ VAT and w/IRS

Amount paid to the service provider = 2,655.00

Amount delivered to the Tax Authority (Article 101(1)(c) of the CIRS) = 345.00

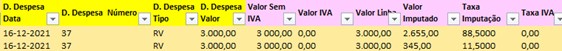

The amount that should appear in the "D. Expense Amount" cell is the Base Amount of the receipt.

In the first line (amount paid to the service provider) the imputation rate should be measured as follows:

Charge rate (1st line) = Amount paid to service provider / Base Amount = 2,655.00 / 3,000.00 = 88.50

Imputation rate (2nd line) = Amount delivered to AT / Base Amount = 345.00/3,000.00 = 11.50

The sum of the two imputation rates must be 100. So 88.50 + 11.50 = 100.

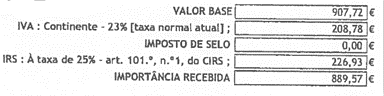

2nd Example: w/VAT and w/IRS

Amount paid to the service provider = Base Amount +VAT - IRS= 907.72+208.78-226.93 = 889.57

Amount delivered to the Tax Authority (AT) (Article 101(1)(b) of the CIRS) = 226.93

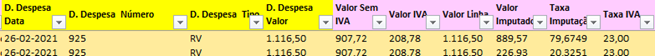

The amount that should appear in the "D. Expense Amount" cell is the sum of the Basic Amount + VAT = 907.72+208.78 =1,116.50.

In the first line (amount paid to the service provider) the imputation rate should be measured as follows:

Charge rate (1st line) = Amount paid to service provider/ (Base Amount + VAT) = 889.57/1,116.50 = 79.6749

Imputation rate (2nd line) = Amount delivered to AT / (Base Amount + VAT) = 226.93/1,116.50 = 20.3251

The sum of the two imputation rates must be 100. So 79.6749+20.3251 = 100.

-

The most correct way is to submit the invoice on the first line and the corresponding credit note on the second line, describing both as fully as possible and correlating the two.

-

In the case of percentage allocations of expenditure, a framework and justification for the percentage allocation must be provided, allowing the expenditure to be analyzed clearly and precisely.

-

Subscriptions for access to publications, databases (among others) must be collective in nature, i.e. accessible to the entire UID Unit and not on an individual basis for each researcher. They must be aligned with the pursuit of the scientific objectives of the funding and consequently contribute directly and exclusively to the realization of the Unit's scientific activity plan.

-

No. Expenses can only be financed if they are supported by invoices, or equivalent documents, issued in the name of the beneficiary (Main Management Institution or participant), under the terms of article 29 of the Value Added Tax Code (CIVA) and receipts or equivalent discharge documents, and all the tax requirements defined, namely article 36 of the CIVA, have been met, and their actual payment has been proven through the financial flow associated with the document.

-

As long as the direct relationship with the pursuit of the project's objectives is safeguarded and a framework has been established, the expenditure will be eligible. However, only the proportion corresponding to the years of funding in force should be charged and not for the 10 years.